The Wallace Insurance Agency Fundamentals Explained

Table of ContentsSome Known Details About The Wallace Insurance Agency Get This Report on The Wallace Insurance AgencyThe Wallace Insurance Agency Can Be Fun For EveryoneThe The Wallace Insurance Agency DiariesThe Best Strategy To Use For The Wallace Insurance Agency

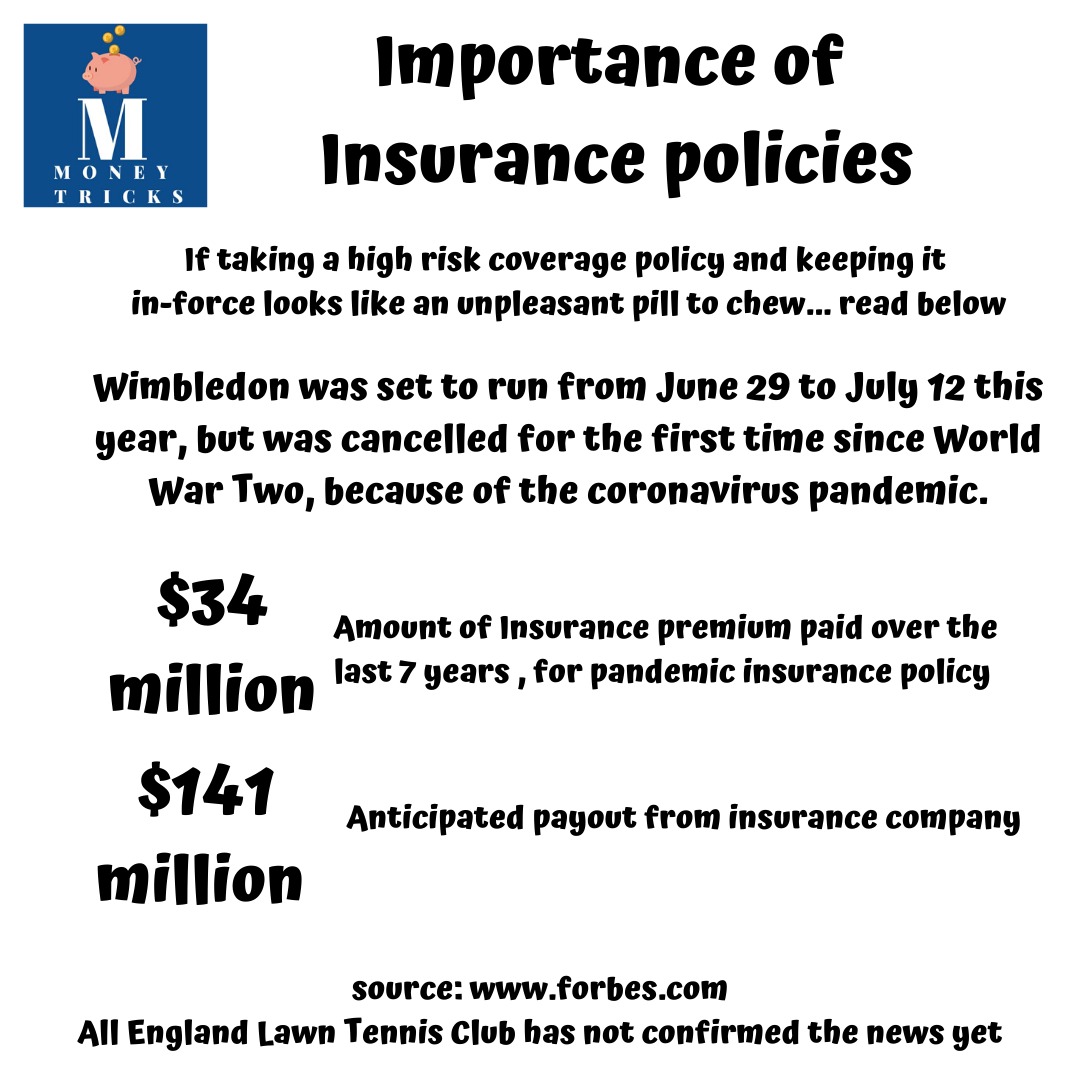

You secure free preventative care, like injections, testings, and some exams, even prior to you fulfill your insurance deductible. If you have a Market plan or other qualifying health and wellness insurance coverage through the strategy year 2018, you do not need to pay the penalty that individuals without protection must pay.There is no denying that you will certainly have better satisfaction if you understand that you and your liked ones are monetarily secure from various unexpected situations. Unpredictabilities in life can emerge anytime, such as an unfavorable fatality or a clinical emergency situation. These scenarios likewise include a mishap or damages to your lorry, residential property, and so on.

You may need to dip into your financial savings or your family members's hard-earned money.

Unknown Facts About The Wallace Insurance Agency

The family members can additionally repay any type of financial debts like home loans or other debts which the individual guaranteed may have incurred in his/her life time Insurance strategies will certainly assist your household preserve their standard of life in instance you are not about in the future (Insurance coverage). This will certainly assist them cover the costs of running the household through the insurance policy round figure payment

They will certainly make certain that your children are financially safeguarded while pursuing their dreams and aspirations without any kind of compromises, even when you are not around Several insurance plans come with cost savings and financial investment schemes along with normal insurance coverage. These help in structure wealth/savings for the future with regular financial investments. You pay premiums routinely and a portion of the very same goes towards life insurance coverage while the various other part goes in the direction of either a savings strategy or investment strategy, whichever you select based upon your future objectives and needs Insurance coverage aids shield your home in the event of any kind of unexpected calamity or damages.

If you have protection for prized possessions and items inside your home, after that you can buy replacement products with the insurance cash Among the most vital advantages of life insurance policy is that it enables you to save and grow your cash. You can use this total up to meet your long-lasting goals, like purchasing a house, starting an endeavor, conserving for your youngster's education and learning or wedding event, and more Life insurance can enable you to remain financially independent even throughout your retirement.

Facts About The Wallace Insurance Agency Revealed

They are low-risk strategies that assist you preserve your existing way of living, satisfy clinical expenditures and meet your post-retirement goals Life insurance policy helps you prepare for the future, while aiding you save tax obligation * in today. The premiums paid under the policy are allowed as tax obligation * reductions of up to 1.

You can save as much as 46,800/- in taxes * yearly. Better, the quantities gotten under the plan are likewise exempt * subject to conditions under Area 10(10D) of the Income Tax Obligation Act, 1961. COMP/DOC/Jan/ 2023/41/1904 There are a number of kinds of insurance strategies offered. Several of the frequently recommended ones consist of the following: Life insurance is what you can get in order to safeguard your family in situation of your fatality during the tenor of the policy.

Life insurance coverage helps secure your family members financially with a swelling sum amount that is paid in case of the plan owner's death within the plan period content This is acquired for covering clinical costs focusing on various health and wellness concerns, consisting of hospitalisation, therapies and so forth. These insurance prepares been available in handy in situation of clinical emergencies; you can likewise avail of cashless facility across network healthcare facilities of the insurance provider COMP/DOC/Sep/ 2019/99/2691.

The Wallace Insurance Agency Fundamentals Explained

When you acquire insurance coverage, you'll get an insurance coverage, which is a legal contract in between you and your insurance coverage company. And when you endure a loss that's covered by your plan and file a claim, insurance policy pays you or a marked recipient, called a recipient, based upon the terms of your plan.

No one desires something bad to take place to them. Experiencing a loss without insurance coverage can place you in a hard economic situation. Insurance coverage is an essential monetary device. It can help you live life with less fears knowing you'll obtain financial aid after a catastrophe or mishap, assisting you recuperate quicker.

Getting My The Wallace Insurance Agency To Work

For car insurance, it might mean you have extra cash to aid spend for repair work or a substitute automobile after a mishap - https://www.avitop.com/cs/members/wallaceagency1.aspx. Insurance can aid keep your life on course, as high as possible, after something bad thwarts it. Your independent insurance policy agent is an excellent resource to discover more regarding the advantages of insurance coverage, along with the benefits in your details insurance coverage

And sometimes, like automobile insurance and workers' payment, you may be needed by regulation to have insurance policy in order to safeguard others. Discover our, Insurance alternatives Insurance coverage is essentially a gigantic rainy day fund shared by numerous individuals (called insurance policy holders) and handled by an insurance provider. The insurer makes use of cash collected (called costs) from its insurance holders and other investments to spend for its operations and to fulfill its guarantee to insurance policy holders when they sue.